"LJ909" (lj909)

"LJ909" (lj909)

10/11/2019 at 12:02 ē Filed to: Finance, Idiots, Buyers Remorse

3

3

47

47

"LJ909" (lj909)

"LJ909" (lj909)

10/11/2019 at 12:02 ē Filed to: Finance, Idiots, Buyers Remorse |  3 3

|  47 47 |

Another example of financial illiteracy. Probably worse. So this person had a Nissan. They didnít say what model they had. But it was a Nissan that they were paying $300/month for. For a reason that could only be explained as they ďgot gotĒ i.e. the dealer played them aka they are dumb as hell, they got talked into LEASING(!) a 2019 Lexus IS for, wait for itÖ$ 800/month. Its sick and should be criminal on the part of the dealer if it werenít for how stupid this person is. What makes it worse is that they were upside down on the Nissan and rolled the negative equity into the lease.

They are distraught to the point where they said they feel sick and have been crying as the realization of the shit they just jumped into hit them when they drove off the lot. I mean, thereí

s just no words. Look at their tomfoolery explanation as to why they didní

t walk when the dealer hit them with $800 payment: ď

I was upside down with my last car. I am FREAKING TF OUT. LIKE. The reason why I got it was that my parents said theyíll pay half. but knowing them, sometimes they can be unreliable. I want to be able to afford it on my own. My lifestyle will have to change drastically, I cannot let this happen. I am getting ready to go over there to see if I can get rid of it. I hate looking at it!Ē

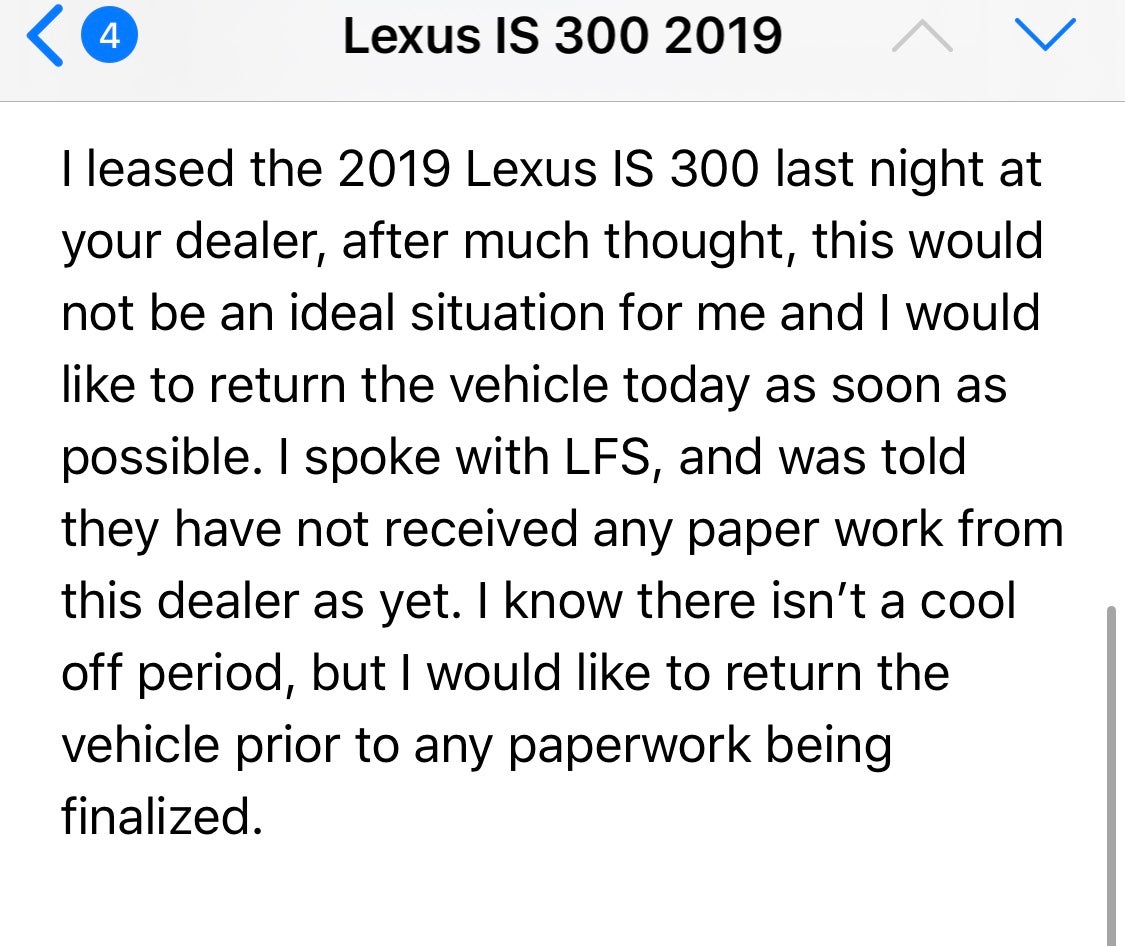

They then posted a screenshot of the email they sent to the dealer asking to be let out of the lease contract:

After some hours of updates, they made it to the dealer but stated they werenít going to take the car back, but try to get them in another car or see if there are other options . Which I doní t know how thatí s going to work considering the only other car thatís cheaper or around the same price as the IS that Lexus makes is the UX. Other than that they would have to go used.

Oh other tidbits that makes this situation laughably worse?

They are a college senior.

Said their credit score is in the low 600ís

Owed 8k on the Nissan and the dealer gave them 6.

They only put $1,000 down

This person is shady and dumb as hell. Stated that they originally got into their Nissan by bringing in fake pay stubs at a dealer known for selling repos ( and with them being local I know exactly what dealer they are referring to)

Had a 23.9% apr on the Nissan with payments of $302.45/month.

Payments were so high they still owed $8500 after buying it for $9,249 last year.

Credit score was only 500 at this time

Initially got approved for the Nissan at 15%, but got a call from the dealer saying to bring it back, where they found another lender that would only do it at 24%

The apr on the Lexus is 16%

They were also on the phone with Lexus financial seeing what their options are. They are in SoCal like I am so there is a cooling off period of 3 days which it seems they were trying to use to see if they could get out of the contrac

t. B

ut they are stuck since this only applies to vehicle sales, not leases. A

pparently they went stated income because they said they provided bank statements showing deposits as well. This doesnít make sense as, unless this is a really shitty dealer which its looking like it is, dealers typically will only do stated income if the credit score is there to back it up. Unless she had some serious income coming in (or forged docs to make it look like she does).

Iím really curious though as to what dealer this is but the person is being vague on the details. The more I look at this the more it doesnít make sense. The person also mentioned that this is indeed a Lexus dealer (which makes sense as its a brand new IS) and that they got denied at other dealerships, from used ones to even a Nissan dealer, which is notorious for putting low score people into Versas,Sentras and Altimas. How they approved this person is shady. A college student with a low 600 credit score, meager work history (Iím guessing) and low income shouldnít have been approved for a nearly $40k car with a $800 lease payment.

Ultimately t hey ended up updating and stated that the dealer only agreed to take $40 off the monthly payments, and they threw in complementary repairs to ease the pain. Dumb. Just remember people, always re ad before signing.

VajazzleMcDildertits - read carefully, respond politely

> LJ909

VajazzleMcDildertits - read carefully, respond politely

> LJ909

10/11/2019 at 12:18 |

|

You have to jump through a lot of hoops, many of them on fire and not easily accessible, as well as lie about your jumping ability before you wind up in this situation.

You say read before signing - Iím not convinced this person read anything at all, ever. What the ever living fuck.† My Drivetime loan wasnít this bad.†

vondon302

> LJ909

vondon302

> LJ909

10/11/2019 at 12:18 |

|

Omg. I just can't even comprehend this.

For Sweden

> LJ909

For Sweden

> LJ909

10/11/2019 at 12:21 |

|

At a 23.9% APR, buy the car with a credit card and get some cash back

Camshaft Chris: Skyline/McLaren/Porsche Fanboy

> LJ909

Camshaft Chris: Skyline/McLaren/Porsche Fanboy

> LJ909

10/11/2019 at 12:22 |

|

Something seems fishy here, on both sides. I feel like thereís a WHOLE lot of information being left out by the lessee. First off, if you had trouble with your $300/month payment, why on earth would you even momentarily consider a payment thatís more than double that?? And for a lease no less??? Thatís absolutely ridiculous . Second, like you mentioned, why the hell did that dealer even agree to approving that person? Having worked in a luxury car dealership , Iíve seen people with better financial situations than that get told to pound sound when trying to get a base model C Class.

LJ909

> VajazzleMcDildertits - read carefully, respond politely

LJ909

> VajazzleMcDildertits - read carefully, respond politely

10/11/2019 at 12:23 |

|

Yea the person, based on the Nissan, probably has a history of suspicious or just downright dumb financial decisions. But also based on the fact they said they are going to have to give up their E quinox gym membership, they are a spoiled brat that assumes their parents are going to help them foot the bill.

I know now Drivetime loan this bad, and some of their loans can be bad.

Thomas Donohue

> LJ909

Thomas Donohue

> LJ909

10/11/2019 at 12:24 |

|

Biggest issue here is that they had the Nissan for one year, but were already in the dealership looking at a new 2019 Lexus. That right there makes no sense.

Especially for a college senior.† What were they doing looking for a new car in the first place?

Wrong Wheel Drive (41%)

> LJ909

Wrong Wheel Drive (41%)

> LJ909

10/11/2019 at 12:25 |

|

This is crazy! My hotel rewards credit card has a lower interest rate than that damn Nissan and I would be damned if I ever paid a cent of interest on that card. I was concerned about paying 3% interest on my Subaru over a 2 year loan but that was a couple hundred dollars total at most. I have to imagine that much interest is more than the cost of the car alone!

Nibby

> LJ909

Nibby

> LJ909

10/11/2019 at 12:26 |

|

i donít feel sorry for someone who didnít do his research and didnít really pay much attention until after it was too late

SBA Thanks You For All The Fish

> LJ909

SBA Thanks You For All The Fish

> LJ909

10/11/2019 at 12:26 |

|

Is there a 24-hour res cission right in their state?† Some way to unwind it? Fast.

SBA Thanks You For All The Fish

> For Sweden

SBA Thanks You For All The Fish

> For Sweden

10/11/2019 at 12:27 |

|

Thatís the outside the box thinking needed...

LJ909

> Camshaft Chris: Skyline/McLaren/Porsche Fanboy

LJ909

> Camshaft Chris: Skyline/McLaren/Porsche Fanboy

10/11/2019 at 12:27 |

|

Yea they are leaving out a lot. The person pretty much said that they are aware of the situation, and doní t want to embarrass themselves further by giving away too many financials or details.

Their reasoning for going for the Lexus though is that their first car was a Lexus that was passed down to them. They liked how nice and reliable it was and thought they could try and get one since the Nissan had started to give them shit.

Chan - Mid-engine with cabin fever

> LJ909

Chan - Mid-engine with cabin fever

> LJ909

10/11/2019 at 12:29 |

|

ĎMurica, 2007.† Except itís 2019.

LJ909

> Thomas Donohue

LJ909

> Thomas Donohue

10/11/2019 at 12:30 |

|

Exactly. But they mentioned that something big is wrong with the engine on the Nissan, to the point that they recently got hit with a $2800 repair bill for whatever is wrong. And the car is only with $4k now.

But they are pretty much a spoiled brat thats hoping their parents are going to help.

Nothing

> LJ909

Nothing

> LJ909

10/11/2019 at 12:32 |

|

Does not compute. Iíd be willing to bet itís a third party lease (when I looked at Challengers, the least expensive leasing option wasnít through Chrysler Capital).

facw

> LJ909

facw

> LJ909

10/11/2019 at 12:32 |

|

With a 500 credit rating, Iím wondering if they might do best just to return the car to the lease holder and default on their payments (I donít know how bad this is, but their credit is already crap, and it sounds unlikely they could afford the payments anyway, so itíd be question of when, not if.)

Regardless, itís evident we need better financial education in this country (and the CFPB needs teeth).

LJ909

> Wrong Wheel Drive (41%)

LJ909

> Wrong Wheel Drive (41%)

10/11/2019 at 12:34 |

|

Yea I ran the numbers and they are going to be paying LS money for an IS.

LJ909

> SBA Thanks You For All The Fish

LJ909

> SBA Thanks You For All The Fish

10/11/2019 at 12:35 |

|

Its California. Weíre good here so this person is stuck. Last I read, they were thinking of some way to sell it off in a few months.†

Thomas Donohue

> LJ909

Thomas Donohue

> LJ909

10/11/2019 at 12:36 |

|

The $2800 should have fixed the car so they didnít need a new one, otherwise donít pay the $2800.

Also, donít go to a Lexus dealer!† Still shocked they got financing, but looks like lots of issues going on there.††

LJ909

> Nothing

LJ909

> Nothing

10/11/2019 at 12:38 |

|

Surprisingly they said its through Lexus Financial, which makes this all make even less sense.

SBA Thanks You For All The Fish

> LJ909

SBA Thanks You For All The Fish

> LJ909

10/11/2019 at 12:40 |

|

Oh. Good luck. I hate myself for feeling empathetic for dumb people but if they donít get help now thereís always the risk theyíll be living down under the viaduct at the end of State Street with everybody else in a couple of years.

LJ909

> facw

LJ909

> facw

10/11/2019 at 12:41 |

|

Thatí s what I was thinking. Their best route might be to take the score hit and do a voluntary repo. Or have Carmax take it off their hands. I think they take lease returns?

But yes, the CFBP needs to crackdown on dealer sales practices. Sales people or dealers as a whole should have financial consultants so people can know what they are getting into.

Sovande

> LJ909

Sovande

> LJ909

10/11/2019 at 12:42 |

|

I make $125,000 a year and have an excellent credit score. $800 a month would make me nauseous. I can't see paying that much for something that is worth less every single day.†

merged-5876237249235911857-hrw8uc

> Thomas Donohue

merged-5876237249235911857-hrw8uc

> Thomas Donohue

10/11/2019 at 12:43 |

|

Ding ding ding. Thatís the second bad decision. The first was made a year ago when they bought the Nissan. And now they just made a third, and worse decision to lease the Lexus.... wow, just wow.

They will be paying $9600 a year for renting a car they wonít own at the end of the term. †Holy cow, how ignorant can a person be? †I just canít believe the parents didnít try to step in at some point to save theyíre child from their own stupidity. †Wow.

Nothing

> LJ909

Nothing

> LJ909

10/11/2019 at 12:44 |

|

Very much so. It reminds me of my military days, where dealers would prey on 18 year olds and get them in cars they couldnít afford. So many people get starry eyed when they find out a dealer can get them in a car.

Heck, Iím still nervous as heck only having a year and a half left on the Ď19 4Runner at 1.9% in a payment we can easily afford. I may be impulsive when I buy vehicles, but I never let it cloud my financial judgment. (Impulsive meaning Iíll research the crap out of something for 6 month , think about it for three or four months, then go buy it.)

Thisismydisplayname

> Camshaft Chris: Skyline/McLaren/Porsche Fanboy

Thisismydisplayname

> Camshaft Chris: Skyline/McLaren/Porsche Fanboy

10/11/2019 at 12:46 |

|

If they can get someone to lend the money then why does the dealer care? †They make a sale. †They arenít in the business of saving stupid people from themselves. †

LJ909

> Nothing

LJ909

> Nothing

10/11/2019 at 12:50 |

|

Thatí s exactly what happened hear. Ií m sure they played into the fact that their hadnít been approved anywhere else. And for that to happen to someone thatí s been denied a bunch of other places and have a luxury dealer approve them? It was a wrap from there.

ITA97, now with more Jag @ opposite-lock.com

> LJ909

ITA97, now with more Jag @ opposite-lock.com

> LJ909

10/11/2019 at 12:52 |

|

My best friend is something like this. For years he got ants in his pants and had to buy a new car every six months or so and got into a cycle where he was buying a brand new car with negative equity rolled in and then trading it in six months later and rolling in even more negative equity the next cycle. At one point he bought a bright red rs/sb Ram 1500 with a hemi for $27k and then traded it in for $18k six months later...

The last time (3 cars ago) I asked about any details, he bought a new, rental car spec C harger for $19k after incentives and dealing , but financed $ 34K with all the negative equity from past trade cycles. He was paying over $600/month to drive a rental car spec Charger. He at least knows to buy the GAP coverage . From what I can tell, his only hope might be for someone to hit him and total one of these cars to let the GAP coverage take care of the negative equity so he can start over again from even.

Since the Charger, heís traded in and bought a 300C w/ hemi, a Dodge Journey and recently a C hevrolet Colorado. Like his former Hyundai Veloster, he once told me he kept getting Chrysler products in part because there were the only dealers that would finance him at the time (pays his bills, but there are apparently a limited number of banks willing to finance 50%+ negative equity into new car loans). Between his experience and things I read over the years about Chrysler financial, I think they might finance one of my dogs into a new car. As far as I can tell, s elling crappy cars on †outdated platforms to folks no one else will finance might be the reason they exist outside of the Ram/Jeep line.

I tried talking to him about this a few times over the years, but it only dragged on our friendship dating back to 8th grade. Now when he gets a new car I just check it out and never ask about the details. I probably donít want to know at this point. At least the last 3 cars heís kept for 1-2 years before trading in.

LJ909

> ITA97, now with more Jag @ opposite-lock.com

LJ909

> ITA97, now with more Jag @ opposite-lock.com

10/11/2019 at 13:00 |

|

Hes insane. And with every trade hes just being handed a shovel and being told ď its ok dig deeperĒ . But youíre right about Chrysler financial. They approve anyone. Its why Challengers are the muscle car sales leaders right now, and why I see so man Scat Pack Chargers on a daily basis. I see as many as Altimas and Camrys †now. Its even to the point that one local Chrysler/Dodge dealer I know has a low credit score incentive if youíre wanting to get into a Scat Pack.

RPM esq.

> LJ909

RPM esq.

> LJ909

10/11/2019 at 13:12 |

|

Had a 23.9% apr on the Nissan...

Credit score was only 500 at this time

The apr on the Lexus is 16%

I didnít even know you could get a car loan with a credit cardís interest rate. The $1000 they put down on the Lexus and $500 per month in higher payments sure would have helped if they had applied it to that terrible Nissan loan...do that for a few months, refinance the remaining 5k balance at a better rate, and all of a sudden theyíre right side up. Another six months down the road and trading it in might be financially feasible if they really must have something new.

MKULTRA1982(ConCrustyBrick)

> Sovande

MKULTRA1982(ConCrustyBrick)

> Sovande

10/11/2019 at 13:24 |

|

Right??!?

VajazzleMcDildertits - read carefully, respond politely

> LJ909

VajazzleMcDildertits - read carefully, respond politely

> LJ909

10/11/2019 at 13:36 |

|

To put in perspective: I had defaulted Govít issue student loans, and my credit score was an eye watering 460. I had 2 CCís sent to collections as well, since I just didnít have money to pay them while in school and I got in over my head.

Drivetime got me a 2000 Kia Sephia that they sold for 7999, I was advised by my then-friends that it was a good offer

back in Ď

03

,

biweekly payments over what turned out to be 39 months at 29%. Like, $

135 every two weeks.

Well, I worked my fucking ass off on $10.5 an hour + OT

and paid off that thing in 2.5 years, and I made it last 4 before my general incompetence killed it. It was my first financed car and the most miserable years

Iíve ever had.

My credit score is 800+

†now because I damn well am never going back to that shit, this is momís spaghetti for me. One final shot at real freedom by busting my ass until my hands and legs and brain donít work.

This personís car situation is still way worse. An incredible turn of events. Surely some local news agency would be able to leverage this, itís just plain ridiculous.†

Arrivederci

> LJ909

Arrivederci

> LJ909

10/11/2019 at 13:47 |

|

Sales people or dealers as a whole should have financial consultants so people can know what they are getting into.

LMAO - like a dealer is gonna ever pay someone to tell damn near every single one of their high- margin clients why they shouldnít buy a new car and keep their 2007 Malibu.

Arrivederci

> For Sweden

Arrivederci

> For Sweden

10/11/2019 at 13:48 |

|

And then pay that sumbitch off with another credit card.

Tripper

> For Sweden

Tripper

> For Sweden

10/11/2019 at 14:28 |

|

lol I wonder what kind of cc heíd get approved for at this point. Iíd guess the same interest rate and a sub 5k limit.

Tripper

> LJ909

Tripper

> LJ909

10/11/2019 at 14:28 |

|

This post is like that show hoarders. Itís painful to read but I cant stop!

Nick Has an Exocet

> LJ909

Nick Has an Exocet

> LJ909

10/11/2019 at 14:34 |

|

This is going to be my brother. He gets taken every time he goes into a dealer and heís not the bright est bulb . Back in Massachusetts, he bought a 2010 Corolla from a Nissan dealer. They tacked on GAP, a $2000 warranty, paint protection, and some other crap that inflated the price by 25%. My mother helped him work his finances to pay it off and a month later, he went into a SoCal Toyota dealer (after moving), traded it in on a new 36k mile Corolla lease. They gave $500 or something for his trade and he got a bad deal on the lease with an insanely high residual - he ďdidnít think leases were negotiableĒ (UGH). Heís a Lyft driver and has put 130k miles on it in under 2 years. Heís going to end up paying more interest on the residual when he has to buy a 200k+ mile Corolla for $15k. In the end, heíll have paid well over $30k for the car.

Camshaft Chris: Skyline/McLaren/Porsche Fanboy

> Thisismydisplayname

Camshaft Chris: Skyline/McLaren/Porsche Fanboy

> Thisismydisplayname

10/11/2019 at 14:43 |

|

In my luxury dealership experience, if someone came in with $1k down, upside down in a Nissan, and that kind of credit, the dealership wouldnít be bothered with putting any effort into the deal and just assume no one would finance that mess.

dtg11 - is probably on an adventure with Clifford

> LJ909

dtg11 - is probably on an adventure with Clifford

> LJ909

10/11/2019 at 16:02 |

|

Reminds me of a guy I used to work with who HAD to have a truck. He was 18, parents wouldnít help him. So he went and spent $15k on an 07 F150 with the 5.4 triton. He had a 35% APR because no bank wanted to give him anything. Last I knew, he was working 2 full time jobs to pay for his truck that now only runs on 7 cylinders and needs to have the engine completely replaced†

Bylan - Hoarder of LS400's

> LJ909

Bylan - Hoarder of LS400's

> LJ909

10/11/2019 at 17:58 |

|

This was really painful to read. Like holy moly, 24% APR!?! HOW!? I cant feel sorry for people who get screwed over signing papers for something they absolutely dont need. If your underwater on your POS Nissan how can you think youre better off leasing a brand new L exus?

I also work at a lexus dealership and I have noo idea how this person got approved for a lease. We wouldve shown them the door with a smile and a wave.†

ranwhenparked

> LJ909

ranwhenparked

> LJ909

10/11/2019 at 20:48 |

|

Iím thinking this person should not be financing or leasing any car, and should maybe be cruising Craigslist for some $2000 beaters.

Not really sure what responsibility the dealer has in this situation, I mean, they were definitely unscrupulous, but this person had no business even looking at a new Lexus, let alone signing on the dotted line. How could you be in that situation, and not realize until later that you canít afford an $800 a month payment? I mean, even if you totally suck at budgeting,† you should have at least a general idea of what your monthly income and expenses are.

LJ909

> ranwhenparked

LJ909

> ranwhenparked

10/11/2019 at 21:03 |

|

The dealer shouldnít have even ran anything on this person. Yea the person should have walked but they had no business even presenting a deal like this. Any reputable †luxury dealership wouldíve politely shown them the door.

ranwhenparked

> LJ909

ranwhenparked

> LJ909

10/11/2019 at 21:06 |

|

Almost as if the salesman was just transferred from the Mitsubishi dealer across the street.

gmporschenut also a fan of hondas

> Nothing

gmporschenut also a fan of hondas

> Nothing

10/11/2019 at 21:43 |

|

that enlistment and reenlistment are paid in lump sums should be criminal. A couple relatives in the military and the stories of 20 year olds showing up with bmws, harleys f150s with the first time their bank ever hit 5 figures, just makes you sad. †

gmporschenut also a fan of hondas

> LJ909

gmporschenut also a fan of hondas

> LJ909

10/11/2019 at 21:48 |

|

I have a cousin that used to work for a dealer, now in real estate and ts stories like this that make me assume another crash is coming. That the fuckery that caused the last recession is just going to repeat. . †

Nothing

> gmporschenut also a fan of hondas

Nothing

> gmporschenut also a fan of hondas

10/11/2019 at 22:29 |

|

I completely agree. I entered the military a little later than most. I remember going on a test drive of a new SLK230 with a guy that still lived in the barracks. If I remember, take home pay at the time (without any BAS, BAH ) was somewhere near †$800 /month . The salesman was dead serious about getting him in the car for about $700/mo.

ranwhenparked

> ITA97, now with more Jag @ opposite-lock.com

ranwhenparked

> ITA97, now with more Jag @ opposite-lock.com

10/11/2019 at 22:37 |

|

I had a friend/coworker like that. In the 6 years we worked in the same office, he went through 3 Honda Pilots, an F-150 Platinum, an F-250, an Accord, and a Mustang - always financed, never leased, and he frequently rolled balances onto the next loan.

Also once bought a 2-axle cargo trailer because he went on a balloon ride and decided he wanted to buy a hot air balloon of his own and needed to have a trailer to haul it. He never got the balloon, but traded in the cargo trailer toward a camping trailer after a few years.

Heís kept up the same pattern since changing jobs - bought a brand new Ram Laramie Longhorn on the day he quit a job with nothing else lined up , because his company had an employee discount arrangement with FCA and he wanted to make sure he could still use it.

He has since filed for personal bankruptcy, wiped out everything but student loans, and purchased a CPO Accord.†

InFierority Complex

> Nothing

InFierority Complex

> Nothing

10/14/2019 at 03:39 |

|

Lol, the barracks parking lot after coming back from deployment. Full of newish mustangs/challengers, big ass trucks, and bikes. Several months later I was one of only a few guys in the platoon to still have a car.

To be fair I also bought a car when we got back, but it was a 86 Fiero in 2012....